That it complete-provider standard bank are prepared to serve all of our top patriots; experts, productive military professionals in addition to their family. USAA is actually a fusion between a card relationship and you will a bank giving parts of both. Created in 1922 in the San Antonio, Colorado, the organization is continuing to grow in order to suffice no less than 77 billion solution professionals within this nation. USAA isnt an openly traded providers. Merely participants normally be involved in the new programs USAA also provides, which allows USAA supply novel positives and you will including the USAA home loan rates.

USAA even offers domestic refinance costs that will be old-fashioned, changeable services more 66 percent of their funds was recognized because of the Virtual assistant fund. The service concerns all of our armed forces team; officials, troops and their family members. With respect to the team, cashouts shall be paid back or, for those who seek a USAA re-finance since you has encounter trouble, that loan officer commonly consider your position and you will show the loan re-structuring possibilities. USAA performs entirely co-process to the current authorities programs.

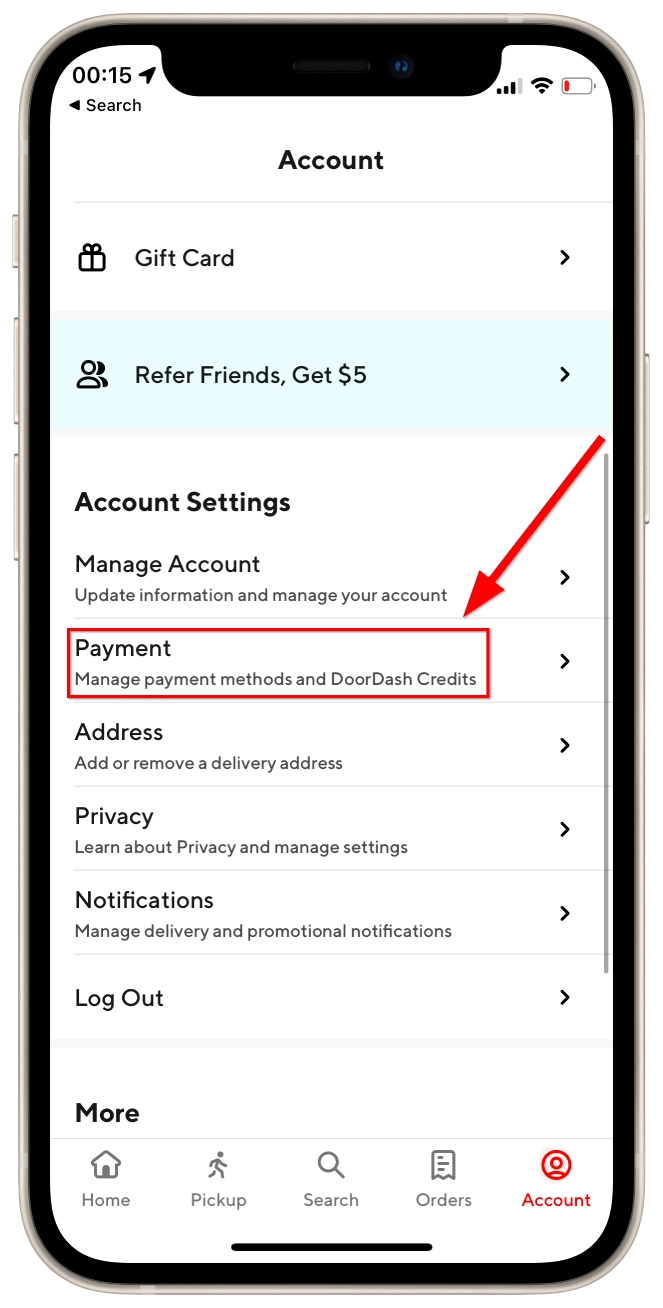

Military, retired and energetic obligations, including relatives from armed forces personnel are entitled to USAA home loan refinance cost (Photo/Pexels)

Refinancing factors given by USAA

All loan providers bring different activities. See every one of USAA’s refinancing rates selection. Currently, USAA household re-finance apps ban domestic security fund and house guarantee distinctive line of credit (HELOC).

- 30- seasons repaired rate

- 20-seasons fixed speed

- 15- 12 months repaired rate

- 10-seasons repaired price

Just like any repaired rate money, the interest rate your invest in will not to switch along side existence in your home loan. A predetermined-price mortgage can make budgeting to suit your homeloan payment convenient than just having a changeable price financial. USAA financial prices also offers terminology ranging from ten to 29-age. Unmarried family members mortgage number tend to cap in the $424,a hundred each the market industry restrict. Having USAA re-finance costs, consider their site directly, or call them toward mobile phone. Fundamentally, minimal loan amount within USAA was $fifty,000 but may wade of up to $step three mil. Through the fixed-rate home loan choices at USAA individuals can refinance doing 95 percent of your value of their home.

Case loans keeps a shorter term than extremely traditional repaired-rates home loan words however, feature a tempting extra. The quicker terms and conditions also suggest lower rates. One to downfall of a supply is the large monthly obligations you to match a smaller title.

USAA will not signify the brand new regards to Case having refinances, like many almost every other issues having USAA you need to make them into the mobile phone. Pre-acceptance procedure, but not, can be viewed in the web site: usaa. Shortly after pre-approval is accomplished and you will a purchase price is in place, the site candidate is complete the processes toll-free by the cell. Just like any lender, the rate you’ll secure upwards-front is determined by the borrowing profile and loan amount.

- Virtual assistant finance

Are a lending institution you to caters to group having army ties, it’s wise one USAA’s good room is during its USAA Virtual assistant loan products. Over 50 % of USAA’s mortgage organization comes from Va fund. T the guy zero-payment Virtual assistant Interest Reduction Home mortgage refinance loan (IRRRL) is tough to beat to other finance companies. USAA including lets Va consumers so you can refinance as much as 100 % of your property value their property. USAA formations its Virtual assistant finance into the 10-, 15-, 20- and you may 30-season terminology.

USAA home loan pricing now

USAA re-finance pricing have become competitive to other pricing throughout the market. USAA will need an excellent homeowner’s most recent loans stream and record towards the thought during the choosing an excellent refinancing rate. USAA’s on the web possess try not to customized rates of the topography, credit history, or any other guidance. To get most recent and you may designed prices for the financial predicament, you will need to call USAA personally.

How do USAA’s circumstances compare with most other banking institutions?

USAA against. Pursue financial When you’re entitled to an excellent Va mortgage, or an enthusiastic IRRRL it definitely is practical on how best to start your hunt at USAA. As we said, there are no fees of IRRRL mortgage, which Chase never already overcome. Away from IRRRL fund, USAA charge a .50 % origination percentage. If you would like safer a supply loan otherwise a non-Va repaired price mortgage, store both finance companies. He is as nice as most other home loan device pricing as well as their origination fees might be similar.

USAA against. PNC home loan USAA cannot already take a look at option kinds of credit rating, such as for example lease payments, regarding a person’s complete credit reputation. PNC does. Your own borrowing from the bank character might possibly be one of the components one to dictate your rate. If for example the credit score means certain repairs, but refinancing are unable to wait, you could potentially think shopping during the PNC basic, even though you need to secure an excellent Va financing.

USAA compared to. Navy Federal Once the various other standard bank concerned about helping military players in addition to their family evaluating Navy Federal to USAA to possess Va mortgage opportunities is essential to possess testing. If you are one another towns and cities claim to perform 50 % or higher from their financial company compliment of Virtual assistant, Navy Government are unable to take on no payment IRRRL one USAA offers. Together with, Navy Federal charges a top origination payment by .fifty percent. Toe so you’re able to toe, USAA seems to pull to come a little bit of Navy Federal.

Almost every other considerations whenever selecting a refinance product

USAA doesn’t currently promote home equity money otherwise house guarantee line of loans (HELOC). They might potentially bring the loans Ophir CO product aboard by the end off 2017. USAA including doesn’t offer their contribution within the HARP financing.

Once the USAA pays attention so you’re able to the people and you will actively works to guarantee that they’re not being left about within extremely billed and you may modifying property and you may financing business, the firm looks committed to provider and help for those invested inside. Trying to remain competitive, the firm demonstrably areas its purpose and you may operates to boost toward overall performance particularly towards technical front.

Determining hence choice is best for you

It’s always best to shop around to discover the best financial speed with regards to refinancing. By assessing your individual problem, there are certainly and this facts take advantage of feel to you. When you are qualified to receive USAA home loan interest levels discover specific perks to help you being aside of standard bank for instance the USAA IRRRL unit. Finding the optimum lender isn’t usually from the rates of interest, additionally, it is far better think customer support and you will positioning together with your values.

On the quantity front side, there are many different costs that will compliment a beneficial refi. Whichever bank you are looking at, usually carry out the mathematics to find out if the new fees offset the interest rate. You could potentially discover that banking institutions which have highest rates of interest might be less expensive ultimately.

In a weather where our provider employees requires most of the service and you may understanding we can pick, this company seems to be a good investment for these regarding united states looking to ensure that our services patriots and their family was maintained securely.