- Your home have a giant perception your ability to construct wealth.

- Considering a researcher exactly who examined ten,100 millionaires, you can find three mortgage-associated traps home owners is fall into one to destroy the chances of getting steeped: dragging-out a home loan, keeping the loan to own tax create-offs, and you can using up a home guarantee credit line.

- Opting for a house you can easily pay for is the most this new cardinal legislation of making riches.

It’s a common trying to find those types of who study millionaires. Chris Hogan, writer of «Informal Millionaires: Exactly how The rest of us Founded Outrageous Wealth – as well as how You could Too,» learned 10,100 Western millionaires (recognized as people who have net worths with a minimum of $1 million) getting eight months towards the Dave Ramsey browse team.

According to Hogan, you can find three «mortgage-associated problems that will drive your own billionaire desires of a good cliff.» Brand new millionaires he analyzed were winning while we are avoiding such mistakes, and therefore, as well as good incomes and you can an excellent preserving models, helped her or him create money.

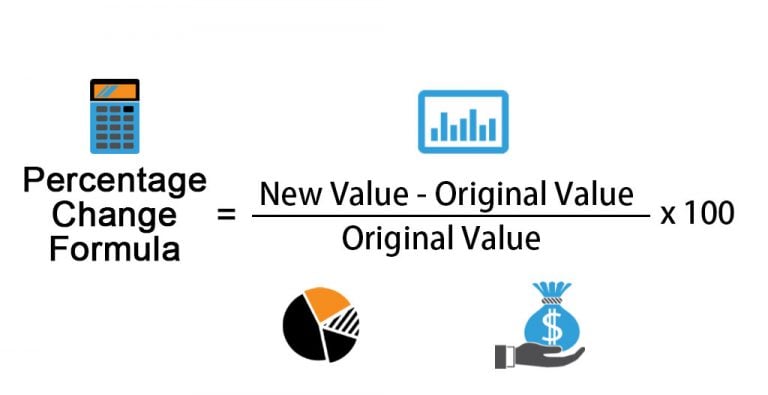

» Should you want to see as to the reasons most people don’t feel millionaires, look no further than brand new 29-season home loan,» Hogan penned. «Someone throw away tens – actually many – regarding several thousand dollars within these funds instead actually ending so you can do the mathematics.»

While you are money level and you can paying habits and additionally sign up for someone’s element to be a billionaire, Hogan’s browse discovered the typical millionaire paid off their residence in 11 many years, and you can 67% of your millionaires he analyzed inhabit house having repaid-away from mortgage loans. This puts the fresh millionaire’s house completely on resource column out of its web value and wipes the most significant personal debt off of the responsibility column, he said.

Hogan opposed a great $225,100 30-seasons home loan having a great $225,one hundred thousand 15-year financial, for every single which have an effective cuatro% fixed rate of interest. He unearthed that, if you’re able to pay the large monthly installments on a good fifteen-season financial, «Heading from the flow and going for a fifteen-year mortgage would have protected your over $87,100000 and you can might have place you within the a premium-to have domestic by 50 percent enough time.»

dos. Keeping your home loan because of taxation positives

As you can write off your own home loan focus on the tax come back, they «will never help save you more than they will cost you your,» Hogan told you.

«You should positively take advantage of the tax deduction so long since you have a mortgage,» Hogan composed, «but never explore that deduction as a reason to save this new mortgage more than requisite.»

Hogan provides a good example from the guide away from a great $two hundred,100000 home loan having a good 5% interest rate. That is $ten,one hundred thousand paid in attention a year, the guy told you, which you can deduct out of your nonexempt earnings. «Whenever you are when you look at the a 25% taxation class, you to deduction can save you $2,500 a-year during the taxation,» he composed. «Because analogy, you sent the financial institution $ten,100, 5000 dollar loan poor credit Campo which enabled one to save your self $2,500 away from your own goverment tax bill.»

He proceeded: «That is for example asking a great cashier to-break a $10 to you personally, however, the guy only will give you back $2.50 – therefore thank him because of it.»

While Hogan’s area stands, it does not look at the the new tax regulations enacted for the late 2017 one to altered the latest government taxation mounts, a twenty-five% tax group no further can be acquired, and you may improved the product quality deduction to help you $several,000 to possess solitary filers and $twenty-four,one hundred thousand getting partnered filers. Which means under the the new income tax laws and regulations, hitched homeowners just who paid off below $twenty four,one hundred thousand during the mortgage interest into season you’ll save yourself more funds of the choosing to allege the product quality deduction, as opposed to itemizing its fees and you can stating good deduction to own mortgage notice.

step three. Taking up a house collateral credit line

A home equity personal line of credit (HELOC) is a revolving loan, like credit cards, backed by the value of a good borrower’s family. To own a fixed amount of time, the financing line exists into the debtor, who will next replenish brand new range or pay-off an excellent balance in the event that time frame try upwards.

Hogan isnt a beneficial proponent from HELOCs. Their lookup found that 63% away from millionaires have never removed property guarantee mortgage or personal line of credit.

«It’s one minute financial linked with a simple-availableness debit card that allows one processor chip away at the residence’s security you to definitely vacation otherwise cooking area up-date at the same time,» Hogan had written. «It will take several incredibly dumb records – a second mortgage and you will a credit card – and you will jams her or him with her on the you to malicious opportunity to sabotage your own monetary independence.»